Chase Interest Rates Chase is a global financial institution that offers a wide range of products and services to our customers. If you need everything from deposits and savings to high-end investments, Chase may be the bank of choice. However, not all Chase customers have the same interest rate. Best Bank Rate You need to check your bank’s offers.

Below is a list of the main tracking account types and current interest rates. And tips for getting the best deals on the chase.

How to Get the Highest Chase Interest Rates

Interest rates have fallen on both sides. Whether you are saving or investing, you want a higher rate. If you have debt, you need a lower interest rate. Factors that affect the rate of return of a chase checking account include the type of account you open. Your credit score plays an important role in getting the highest rate for your credit pursuit, based on the amount you deposit and your current banking relationship.

Chase offers a variety of products to meet most financial needs. Chase checking accounts usually offer 0.01% APY, but there are more interest rate options depending on the type and number of products you deposit in your savings account. They offer everything from 0.01% APY to 0.09% APY. Chase also offers several CDs. A long-term CD is also included. CD accounts offer 0.02% APY over a lower standard period and 0.05% higher ASY over a 120-month relationship, but product type and balance also affect CD rates.

For More Information:

Chase Bank Hours

Chase Mobile Deposit Limits

How To Activate Your Chase Debit Card

Chase Saing Account Rates.

Chase offers two major savings account options: standard and premium savings accounts. Premium relationship accounts with higher balances offer higher returns, but in those cases, you will need to add a tracking checking account and perform at least 5 transactions per month.

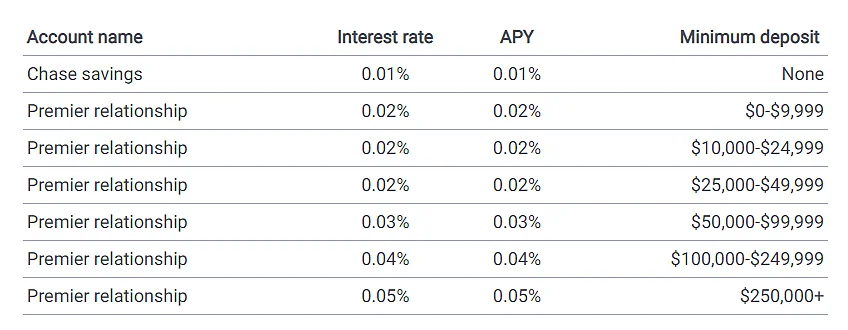

Take a look at the Chase Offer savings account in the graph below.

Note: These rates may vary by market and the Los Angeles region.

Chase Interest Rates Checking Account

Chase offers four types of checking accounts:

Full control tracking

Chase Premier Plus Control

Chase Premier Platinum Control

Check out student hunting.

Only two accounts (Chase Premier Account) pay interest. Regardless of the size of the account or any other banking relationship with Chase, all Chase checking accounts will pay the same 0.01% interest as of April 17, 2018.

For More Information:

Chase Reconsideration Line

Chase Routing Number

Chase Student Credit Card

Chase Interest Rates Mortgage

Chase offers fixed and adjusted interest rate real estate loans. Fixed-rate loans for 15 or 30 years and 7/1 Libor ARM or 5/1 Libor ARM adjustable-rate loans. In other words, these are adjustable rate mortgages and bad mortgages as of April 17, 2018. These are:

30 years, 4.375%, April 4.471%

15 consecutive years: 3.875%, 4.023% in April

1/7 LIBOR ARM: 4.375% rate, 4.772% in April

5/1 LIBOR ARM: Ratio 4.25%, April 4.809%

Not all tracking clients have the highest bank interest rates. Among other requirements, the best way to get a mortgage rate is to cut the interest rate by 20% and get a good loan.

Chase Bank Business Checking Account

Chase Interest Rates Savings Accounts

Chase offers two types of savings accounts:

Track savings

Chase Savings Prime

You can get the highest interest rate on your chase savings to account in one of the three main ways:

Open a Chase Premier Savings Account

Make a minimum deposit of 250,000

Link your account to an active Chase Premier Plus checking account or Chase Premier Platinum checking account.

Deposits earn only 0.01% of Chase Premier’s savings account, but only if you link your savings account to one of two tracked checking accounts. Benefit from a higher return “relationship”. This allows you to get rates from 0.04% to 0.09% depending on your balance, with a maximum deposit of $ 250,000.

For a basic chase savings account, you will receive 0.01% APY on your balance. No matter how much you deposit or have a relationship with a bank

For More Information:

Chase ATM Withdrawal Limit

Chase Direct Deposit

Chase Business Credit Card

Chase Interest Rates Personal Loan

Banks also offer other types of loans, but Chase’s personal loans are not personally available. However, banks are lending money to refinance mortgages. When you apply for a refinance loan, Chase checks your credit history and current situation. If eligible, banks will offer permanent or adjustable home loans with a maturity of 15 or 30 years. The interest rate varies according to all these factors.

Chase Interest Rates Certificate of Deposit

Chase offers CDs ranging from one month to 120 months. Standard 10-year CD rates range from 0.02% APY to 0.05% APY per month.

The first is to link your Chase personal checking account to your CD account. This will result in a higher APY of 0.60%. It is best to use a quick checking account. So the next step is to deposit money into a large account. Or rather adulthood, chase at a higher rate. Chase is doing its best by offering 120,000 + 1.30% APY for the equivalent of a 120 month CD.

People Are Still Asking

How Much interest does Chase Bank pay?

The interest rate on a Chase Savings Account is 0.01% per annum, or APY (effective November 15, 2021. Interest rates are subject to change and are subject to change). The interest rate on the bank’s premium ratio savings account is slightly higher. But overall, APY Chase has fewer savings accounts.

Why is Chase interest rate So Low?

The interest rates for savings are generally lower. This is because many traditional banks do not require a new deposit. Thus, there is no incentive at higher interest rates. But watch out for high-yield accounts that can earn more.

Is It Worth It To Get A Chase Savings Account?

Conclusion: Is this the right statement for you? With more than 15,500 ATMs and 5,300 branches nationwide. If you want access to money, the Chase Bank Savings Account is a good option. Funds are covered by FDIC insurance for up to $ 250,000 per account, so you can deposit with confidence.