Chase Direct Deposit

Direct deposit is a very popular banking method among bankers. 93.8% of American workers obtain funds through direct deposits. According to the United States Payment Methods in the National Payroll Week 2020 Survey, if you’ve never used Chase Direct Deposit before, you should know the following. How to prepare your funds Manage your funds more efficiently.

How to Set up Chase Direct Deposit in 5 Easy Steps?

You can set up Chase direct deposit in just a few steps:

1. Log in to your Chase account from the online app or the mobile app.

2. Go to Account Services and click “Configure Direct Deposit Form” to download the pre-filled “Chase” direct deposit form.

Or download and complete the Chase direct deposit form.

You will need your Chase bank account number, bank code, and current address.

3. Take the termination form and check your employer’s benefits section.

4. Wait for the employer’s salary to be credited to your bank account.

It can take two cycles for direct deposit to take effect.

5. Check your paper monthly statement to verify your deposit or log into your account online.

For More Information:

Chase Reconsideration Line

Chase Routing Number

Chase Student Credit Card

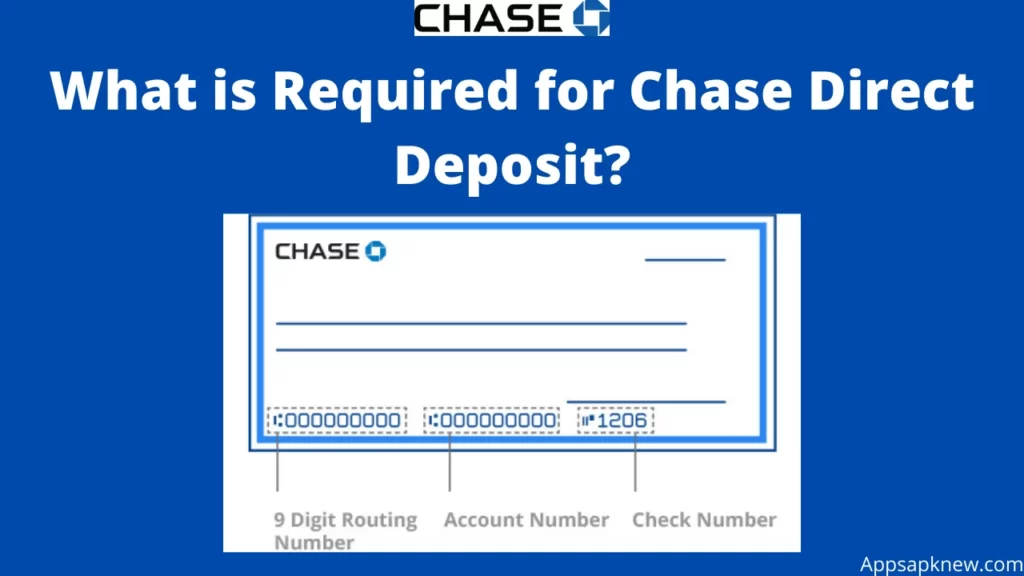

What is Required for Chase Direct Deposit?

To make a direct deposit, you need the following:

1. The name and address of the employer or the depositor

2. Employee ID or consignment number

3. Count your prey

4. Follow the route number.

What are the Advantages of Chase Direct Deposit?

There are many benefits to using Chase direct deposit, and there are a few things to consider.

1. Avoid driving to the bank to deposit checks.

2. Avoid the risk of lost or stolen stamps.

3. In some cases, the money can be used in advance.

4. Avoid monthly maintenance fees.

When is Chase Direct Deposit done?

After submitting the documents to the employer, the direct deposit may require two payment cycles to take effect. Direct deposits are generally accepted immediately after the employer has made the payment. You can set a deposit reminder online or directly in the Chase Bank app to see when your paycheck reaches your account.

For More Information:

Chase ATM Withdrawal Limit

Chase Direct Deposit

Chase Business Credit Card

Chase Direct Deposit: Should I Set It Up?

If you already have a Chase account, you can easily get the government salary and benefits by depositing money directly. In fact, some employers prefer to pay the salary directly because it is cheaper and easier to manage. If you are unsure whether to use direct deposit, please consider consulting an expert

1. Provide free direct deposit

2. You can pay faster than getting stamps.

3. No more going to the bank to deposit a check.

4. Deposits such as lost or stolen checks are not transferable.

5. No need to go straight to the office to get paid, your money is ready.

Track direct deposit payment quickly and easily

Chase Bank Business Checking Account

Now that you know how to set up Chase direct deposit, you can collect your pay the day you send your business to the bank. You don’t have to wait for the check to be paid. Plus, you don’t have to go to the bank to queue. This saves time in sending checks.

Make sure you have collected all the information required for direct deposit, such as the name and address of your employer or depositor. Employee ID or Depositor Account Number, Chase Account Number, Chase Routing Number, etc.

Please note that Chase may require one or two installments for the deposit to take effect directly. Stay with us for a few weeks to view the document. You can set up reminders to know when your direct deposit is over and pay special attention to online banking and mobile apps.

For More Information:

What Is Chase QuickPay

What Is Chase Pay How Can Use It

Chase Dispute Charge

Download Chase APK App

People Also Ask

How Do I Get a Chase Direct Deposit Form?

1. Accept a dedicated, pre-filled direct payment form.

2. Log in to Chase.com or the Chase mobile app.

3. Select a checking account to receive the payment directly.

4. In the mobile app or from the Chase.com drop-down menu, drag your finger to Account Services.

Click or tap “Direct payment options.”

5. To save time, I filled out the deposit form directly.

6. Download, print, or email the form to your employer.

Why Didn’t I Get the Deposit Directly From Chase?

If your chase deposit is processed directly, you must receive this fund continuously from all funds. If the direct payment is delayed, it may be due to a transaction error or the bank received your payroll later than usual. Contact your employer and payroll department to find out.

Does Chase Make a Direct Payment?

In most cases, this process takes 1-3 days. You can halve this time by paying a direct deposit. You can pay for up to 2 days … The 5 banks that offer daily prepaid sales: Chase now offers a $ 225 cash bonus when you open a checking account.

Will Chase Direct Deposits be Prosecuted?

Between 3 pm and 5 pm

In most cases, direct deposits are credited to your Chase bank account between 3:00 and 5:00 on the next business day the owner opens the bank deposit.