Chase Dispute Charge

There are many reasons to Chase Dispute Charge to Chase Account Claims Challenges. Read these useful tips to charge your stock account.

There are multiple reasons for Chase Dispute Charge against Chase Account claims. You can pay for what you did not receive. Defective or defective items The same item may be charged twice. Fortunately, the petition appeal process is short and simple.

If you find a problem with the claim on the card, we recommend that you report it to your customer support team as soon as possible. You can dial the number on the back of the card.

For More Information:

Chase ATM Withdrawal Limit

Chase Direct Deposit

Chase Business Credit Card

What Are Some Examples of Claims that you Chase Dispute Charge with?

Fake Invoice

If your credit card is used for a transaction that was not made by you, it indicates a fraudulent payment. Chase’s terms of service stipulate that cardholders are responsible for 0 fraudulent charges on their card. You are not responsible to them.

If you see an unclaimed claim on your credit card statement. First, make sure that it’s free for your family or authorized customers who have access to your credit card. If you think your charge is fraudulent, you should contact Chase immediately and send your new account number together with your new credit card.

Purchase problem

Please note that sometimes you can buy products or services, but the seller will not complete the transaction. For example, you buy an item from an online seller, but the item is damaged or does not fit when it arrives. Or you can order online. However, if you have not received the goods, it is best to contact the seller first so that they can request a refund.

However, if the seller does not return the goods for any reason, you are fully entitled to refuse the transaction by stacking.

Chase Bank Business Checking Account

Billing error

If you are charged for canceled streaming services or undelivered online orders. You can request a refund by filing an appeal.

The FTC provides the following examples of billing errors:

1. Incorrect bill date or amount

2. Charges for products or services not received or provided.

3. Mathematical errors

4. Do not post other credits, such as payments and returns.

5. Do not ship to the current address-assume the creditor changes the written address at least 20 days before the end of the billing period.

6. A written request or written proof of purchase is required with a false statement or clarification request.

According to the FTC, fake credit card transactions are a form of fraud and are considered billing errors. You can refuse to process.

You can dispute your credit card application by writing to the lender. You can use the letter shapes at the bottom of this guide. During the trial period, you do not need to pay any additional fees. But you must pay the remaining costs. You must write to the lender within 60 days, and the law must respond to you in writing within 30 days.

The issuer must resolve disputes between the two billing cycles. If you do not agree with the final decision, please submit it within 10 days. However, at this point, the lender can begin the purchase process. They should also declare that if they wish to report the situation to a credit bureau, they will not accept the fact that you borrowed money.

For More Information:

What Is Chase QuickPay

What Is Chase Pay How Can Use It

Chase Dispute Charge

Discuss Chase Dispute Charge in Credit Card Costs

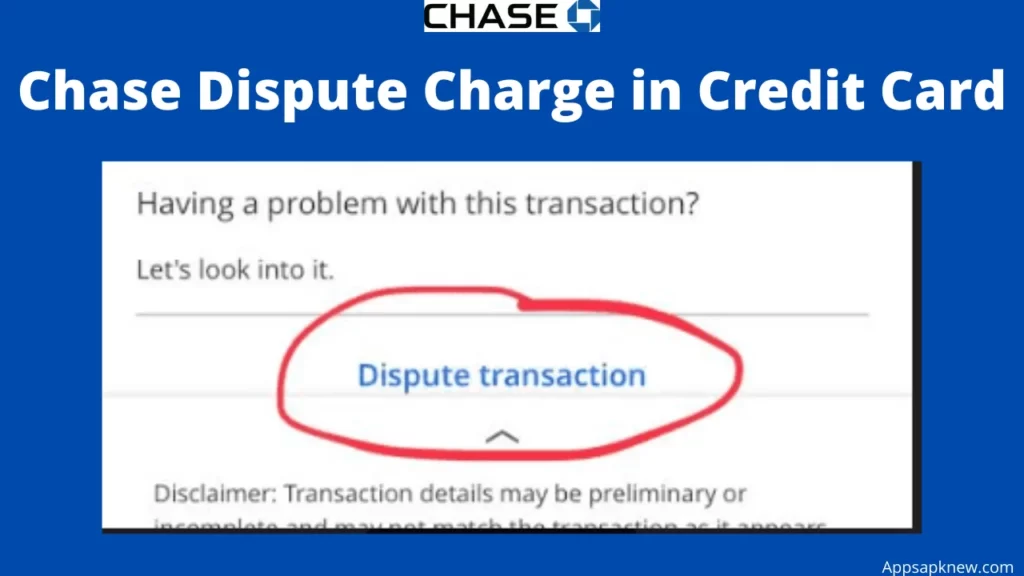

The easiest way to challenge your Chase credit score is to follow these steps online.

1. Sign in to your account and open your Chase credit card.

2. Select the Chase credit card account of the exchange you are challenging.

3. Click next to the arrow where you want to view the trade prices to open the trade details.

4. Click Work Disputes.

5. Complete the appeal form.

The question asks if you disagree with all or part of the total. There are also a series of questions about the causes of the conflict.

You can talk on the phone about the cost of your credit card. If you want to discuss the argument with the person watching you, you can dial the phone number on the back of the chase card.

For More Information:

How to Close a Chase Account

Chase Interest Rates

Chase Money Order

Download Chase APK App

People Also ASK

How Do I Chase Dispute Charge Complaint?

Credit card: Please call. 1-866-564-2262 Starting a Debate About Debt Consolidation Loans You may need to wait for a debit card license to be issued before filing your protest online.

Does Chase fit conflict well?

You don’t have to spend any money to pay with a credit card during the conversation. Chase confirms the claim and contacts the customer … Successful dispute: Chase deducts the bill from the information, reimburses and pays the customer for the transaction amount.