MoneyGram vs Western Union

Compare MoneyGram vs Western Union services and facilities with Western Union to see which features, fees and exchange rates earn the best points. Supported countries and customer service

MoneyGram vs Western Union: Overview and Company Profile

Overview Western Union

Western Union merged with Rochester, New York in 1851 to establish a printing telegraph company in New York and the Mississippi Valley.

As overtime telegraph and telegraph-related services became less common, Western Union began to focus more on the money transfer business. Since 2006, Western Union has been completely focused on international money transfers.

Today, Western Union is headquartered in Denver, Colorado and is a global money transfer giant.

Brief information and facts about Western Union

It was founded in 1851 in Rochester, New York, USA.

Headquartered in Denver, Colorado, USA.

Listed company (brand code WU)

Has 12,000 employees worldwide

Overview MoneyGram

MoneyGram was founded by the merger of Minneapolis-based Travelers Express and Denver-based Integrated Payment Systems Corporation. MoneyGram became independent in 1998 before being purchased by travelers and is now MoneyGram International.

MoneyGram is headquartered in Dallas. In collaboration with Texas, we have built a global money transfer system and a global network of agents and financial companies in the United States.

MoneyGram fast data and information

It was founded in 1980 in Denver-based Integrated Payment Systems Corporation by the merger of Minneapolis-based Travelers Express. In the United States

Located in Dallas, Texas, USA.

Listed company (brand code MGI)

2200 employees worldwide

Now compare Western Union and MoneyGram directly with different values.

MoneyGram vs Western Union: Main points

1.MoneyGram and Western Union are the most popular money transfer services in the world.

2. Determining whether Western Union or MoneyGram is the best service or the cheapest service creates a huge number of price variables.

3. Check the fee calculators available on both companies’ websites to determine the exact price based on the destination and method of remittance and whether there is an exchange rate.

MoneyGram vs Western Union Limits

Western Union determines how much money a customer can send. Consider the following factors:

Where you’re sending to and from

Record a transaction

The type of money you pay

Certain restrictions are imposed by the organization or destination country.

To find out how much you can deliver to a particular location, you’ll need to set up an online payment form, access a Western Union representative, or contact your service team for instructions.

MoneyGram sets a limit of 10,000 for most online transactions, but brokers can also send more. Unless the country you are shipping for payment is subject to restrictions. You may need to provide additional details and documentation to be legal in both the United States and the country of destination.

MoneyGram vs Western Union Money Transfers

MoneyGram vs Western Union Customer satisfaction

Viewing customer reviews and customer reviews online is a great way to test the credibility of a money transfer service. The trust pilot collects customer reviews and gives the company a star rating. Star ratings change from time to time as new reviews are submitted.

At the time of writing, the Western Union Trust Pilot 5 has a rating of 3.6 and a rating of 17,500. [6] Please note that although MoneyGram has a slightly higher rating with 4.1 stars, MoneyGram has less than 4,000 customer reviews pending. .3

It also helps companies understand the distribution of individual customer trust ratios. For example, Western Union has a higher percentage of customers than MoneyGram (64% vs. 56%). Compared to Western Union, most customers reported poor service, averaging 24% to 10.%

Visit the TrustPilot website for the latest reviews and decide which service to use. Are you not sure yet and want to change online? See Wise’s 4.6-star rating. 86% of customers say they use the premium service.

MoneyGram vs Western Union: Prices

It is difficult to determine whether it is MoneyGram, Western Union or any other provider. Is it well suited for a specific transaction? The easiest way to find is to simulate online payments with multiple providers. And see which provider is best for you. Remember to know the exchange rate and prepaid fees you use. Because it has a big impact on the actual cost of payment.

The conversion rate is important because most providers increase the conversion rate they use. As an additional fee but adding it to the exchange rate makes it difficult to calculate how much you will pay for the services you need.

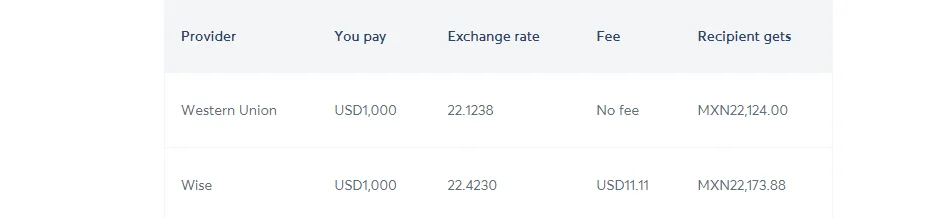

For example, suppose you want to spend $ 1,000 to a friend in Mexico. Here’s how it works with Western Union and Wise:

As you can see, Western Union does not pay any fees for this transfer.

Wise, on the other hand, uses a transparent prepaid exchange rate to deliver real exchange rates to its clients without increasing margins.

In the end, you pay the same amount for both transfers, but with Wise, you get more recipients.

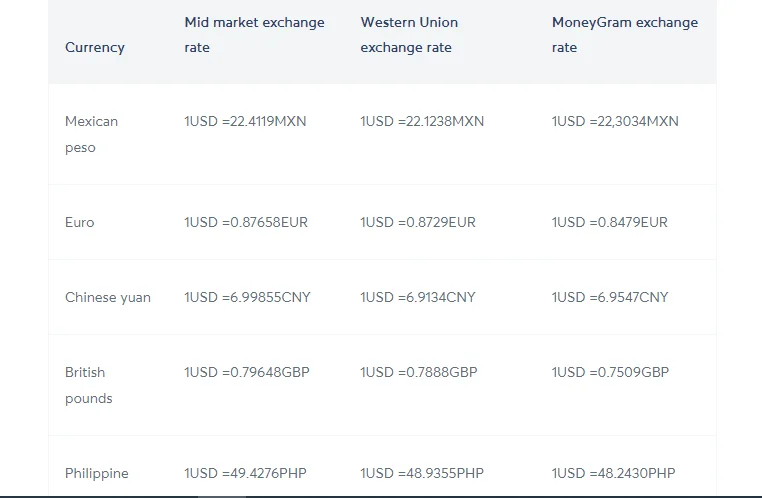

Exchange rates between MoneyGram vs Western Union

Let’s compare the prices offered by MoneyGram and Western Union with the Central Market prices on Google.

You will notice that prices vary depending on the provider. When using currency converters and searching online they are usually not better than the central market exchange rates. This is because margin or profit margin is added to certain exchange rates used. This is an additional cost to the customer and a greater benefit to the supplier.

Here is what the Western Union has to say about exchange rates:

Western Union also makes money through currency exchange. Carefully compare transfer fees and exchange rates when choosing a money transfer company.

MoneyGram also ensures that they or their agents can take advantage of the exchange rates used on their terms.

MoneyGram (and/or in some cases its agents) keep track of the difference between the exchange rate notified to you and the exchange rate received by MoneyGram, as well as any transfer fees.