Chase Student Credit Card

Chase Student Credit Card Young people can get stuck in debt and create good financial habits for the future. Many banks and financial institutions offer credit cards to students. You may want to verify that your US student ID is valid. What benefits can it give you? And what benefits do you get from working with your respected parents or guardians? And the benefits reflect your current chain.

When using, use a Chase Student Credit Card, not a signature machine. (You may need to sign a CO) You don’t understand how the application process works and how the NSF plan handles borrowed credit cards College students can create and manage their own credit cards. Credit cards take advantage of reward programs when used correctly.

For More Information:

Chase Bank Hours

Chase Mobile Deposit Limits

How To Activate Your Chase Debit Card

What is a Chase Student Credit Card?

Although the Chase Student Credit Card has become a type of credit card designed and sold to college students and recent graduates in banks and financial institutions, student credit cards generally do not apply to history or income limits. Minimum credit card and credit limit A CO signature may be required to obtain a 21-point student credit card.

Quality and Features of the Chase Student Credit Card

Chase Student Credit Card usually doesn’t have any additional benefits in September. But there are some benefits to having a Chase student credit card in your wallet for security.

Good returns for 20 years

To celebrate your Chase Student Credit Card account each year, earn a $ 20 (2000 Ultimate Rewards points) reward for qualifying points. You don’t have to open your account by default. And you will be rewarded for the first five ES of account opening.

5% return of the lift car

By March 2022, all your lift vehicles will have a 5% refund (5x points). No matter how strong you are, you can trade loyalty between Lyft and Uber until you get a ride in the spring with this card.

Chase Bank Business Checking Account

DashPass registration for 3 months

DashPass excludes shipping for orders over 12 years. You can consider the opportunity and enjoy this service for free for 3 months. If you wish, you can get a 50% discount on a 9-month subscription (activation required in the USA). December 31, 2021)

Read More: Great Credit Card for Food Delivery

Automatic credit limit increase

Unless you have 5 months of NSF within the first 10 months of opening an account. You have to increase your credit limit.

Travel/insurance coverage canceled

Pursue Freedom: Student credit cards give you peace of mind on the go – you can use up to $ 1,500 per person on your first one-way trip with a non-refundable ticket. You can redeem $ 6,000 for a bad rupee and other features.

Learn more: Best Credit Cards and Travel Insurance

Purchase rules

You get used to it when you are at home and you are calm. If you pay, you can qualify for the Chase Freedom® Retired Student Credit Card ($ 500 to $ 50,000), which is a mass theft range of up to 120 days.

Extended Warranty

3 Eligibility for ES-Faumea Chase Student Credit Card Purchase You may be eligible but may be eligible for an additional year warranty registration.

For More Information:

Chase Reconsideration Line

Chase Routing Number

Chase Student Credit Card

Download Chase APK App

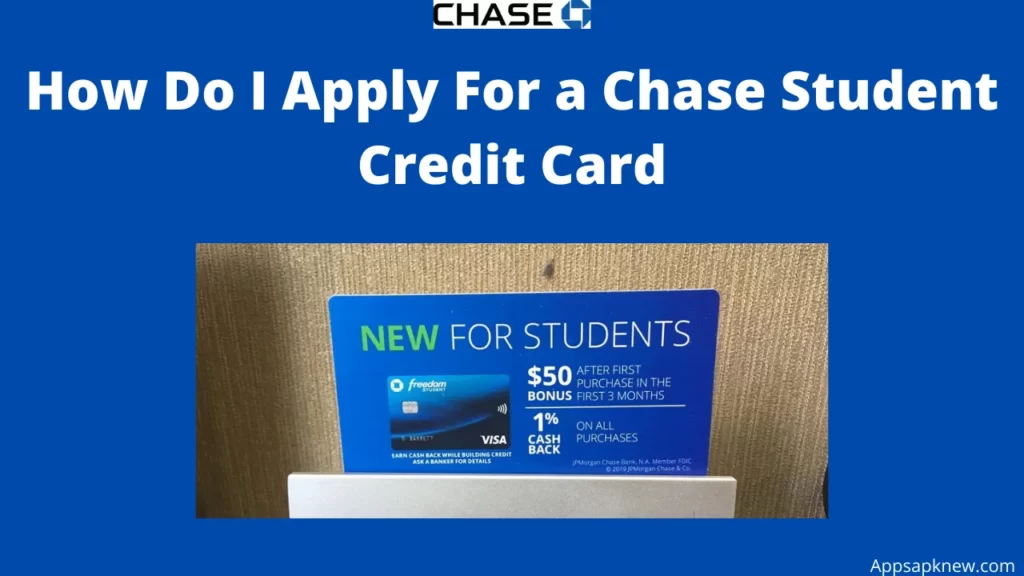

How Do I Apply For a Chase Student credit card When I am over 21?

1. The best type of student credit card for research Learn more about the application

2. Obtain relevant proof of the school you are enrolled in

3. Credit card companies may grant admission to a school recognized by some national bank clearinghouses.

4. Gather information on co-signatories. (US NSF co-signer lost account) and proof of income.

Apply and submit all required documents 5.

For More Information:

Chase ATM Withdrawal Limit

Chase Direct Deposit

Chase Business Credit Card

How Do I Apply For a Chase Student Credit Card if I am 21 or Older?

1. Find the best student credit card type for your needs.

2. Learn more about application requirements.

3. Obtain relevant evidence of personal or property income.

4. Get relevant evidence that you are enrolled in school. Some banks and credit card companies can verify enrollment in qualified schools through the National Clearinghouse.

5. Submit the application with all required documents.

People over the age of 21 are responsible for delaying fixed interest or default payments.) Application process. You may need to provide proof that you are enrolled in a part-time or full-time university. Some credit card companies have specific requirements for establishing a two- or four-year college. Therefore, please clarify these requirements before applying for a student credit card.