Chase Money Order

Most chase branches issue Chase Money Order as long as you have a chase account. The transfer case Money Order fee varies it’s depending on the location. However, it ranges from $ 5 to $ 8 for wire transfer purchases and $ 0 to $ 8 for cash. Below are the details of the chase remittance policy.

How to Get a Chase Money Order

To purchase a Chase Money Order, you need to access the Chase Bank branch. No cash transfer is required online.

To get a Chase Bank transfer, you need to follow these steps:

Make sure the transfer amount is in your chase account or savings account.

Tell the cashier the amount you need. And he prints it for you.

In the Pay on Demand line, enter the recipient’s name.

Keep your receipt if you wish to cancel a truck or transfer.

Replenish black gel ink as soon as you purchase a money order. Place the receipt in the payment order until you are certain that the provider has made a mistake. We recommend that you submit your money order manually. Otherwise, send it directly to the recipient. Recipients must have a photo ID for cash or money orders.

For More Information:

Chase Bank Hours

Chase Mobile Deposit Limits

How To Activate Your Chase Debit Card

Chase Money Order Policy

Chase Money sells and exchanges orders. However, there are some restrictions. Forwarding services are typically provided only to clients. We contacted the Chase branch in Virginia, Florida, Massachusetts, Texas, Oregon, Pennsylvania, Illinois, Colorado, California, and Louisiana. To find out more about chase remittance procedures and fees.

How Much is Chase Money Order?

Money orders are the safest way to pay or send invoices. This is because money orders are prepaid. Therefore, it will not be returned as a personal checkbox.

You can buy money orders from various sellers. And usually, you have to pay a fee. If you are a Chase Bank customer, you may be required to pay a transfer fee of $ 0-5, depending on the type of check account.

Chase Money Order Cost

Chase Checking Customers can purchase up to $ 1,000 in bank transfers. The transfer fee for confirming the type of checking account is as follows.

Chase Checking Account Type Money Order Fee

Chase Premier Plus Checking account $0

Chase Premier Platinum Checking account $0

Chase Total Checking account $5

Chase College Checking account $5

Chase High School Checking account $5

For More Information:

Chase Reconsideration Line

Chase Routing Number

Chase Student Credit Card

Comparison of Transfer Fees Chase Money Order

To check Chase’s wire transfer fees, the competitor’s wire transfer fees are listed below.

1. US Postal Service: Transfer orders up to $ 500 will be charged $ 1.45 and transfer orders from $ 500.01 to $ 1000 will be increased to $ 91.95. Military drafts issued by the military post office cost 50 cents.

Walmart: Walmart MoneyGram will send you up to $ 1,000 with a discount of up to 70%.

3. Wells Fargo and TD Bank: As with Chase Bank, the transfer fees for Wells Fargo and TD Bank depend on the type of checking account linked to the customer. For bank transfers up to $ 1,000, fees range from $ 0 to $ 5.

4. Western Union: Fees vary by transaction volume, location, purchase method and transfer method. You need to confirm this information.

Chase Bank Business Checking Account

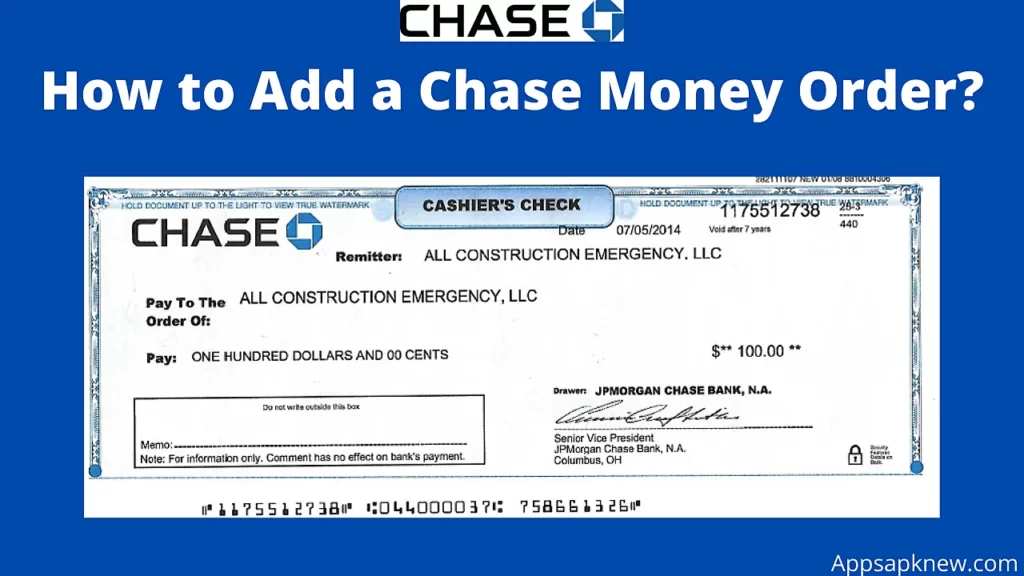

How to Add a Chase Money Order?

You need to go to your local Chase Bank branch. Chase Money Transfer is not allowed online (for security reasons), so Chase Bank has several steps you need to take before accepting a transfer.

First, you need to have a check or savings account. This account should have enough money for the money order you request later. Banks can safely withdraw funds from these accounts.

After checking Chase Bank, you have enough money. After letting us know the amount you want, the staff will print the money order. Then enter a name. Congratulations on the “pay by order” line (or provider name)! The chase bank transfer is complete and ready to go.