Looking for a guide for deposit checks with Chime Well, if you nod your head, you can stop looking. Here’s a step-by-step guide to deposit checks with Chime.

This way, you can learn more about the method.

So if you’re ready, let’s get right into the details.

How Does Chime Mobile Check Deposit Work?

Based on the history of any Chime account, the date and amount of your direct deposit, and other risk factors, we determine whether you can deposit using Mobile Check. For example, if you received at least $1 as a direct deposit, you can use a mobile check:

- Employer or Payroll Provider.

- Financial service providers.

- Government benefits (including child tax credit).

- As an automated clearinghouse (ACH), you receive employer deposits, wages, and government benefits. Gig Economy payments can be made as ACH Transfer or Original Credit Transaction (OCT).

- One business day after we receive your deposit, we will automatically enable mobile verification in your app. Other risk factors may also give you access.

Can You Deposit Checks With Chime?

Yes, you can deposit checks with Chime. All you have to do is submit a scanned photo of a valid check. After checking, Chime will transfer the money to your account. However, you must meet the requirements to be able to send a check to Chime. You are eligible if you have received a direct deposit of at least $200 to your Chime account. Healthy!

Chime is one of the most popular neo banks in the United States, offering many additional features to its users. For eligible users, Chime allows users to withdraw up to $200 in credits, including the SpotMe feature.

Chime Mobile Check Deposit

We’ll see if you can use a mobile check based on your Chime account history, the direct deposit date and amount, and other risk factors. For example, you can use a mobile check if you received a direct deposit, such as at least $ 1:

- Owner or payer.

- Financial services provider.

- Government benefits (including payment of tax credit for children).

- Deposits, wages, and government payments should be accepted as an automated payment center (ACH). Gig Economy payments can be made through ACH transfer or physical credit transaction (OCT).

- One business day after receiving the deposit We will automatically enable mobile verification in your application. Other risk factors may give you access.

- Importantly. Tax refunds cannot be made directly.

How to Deposit Checks With Chime

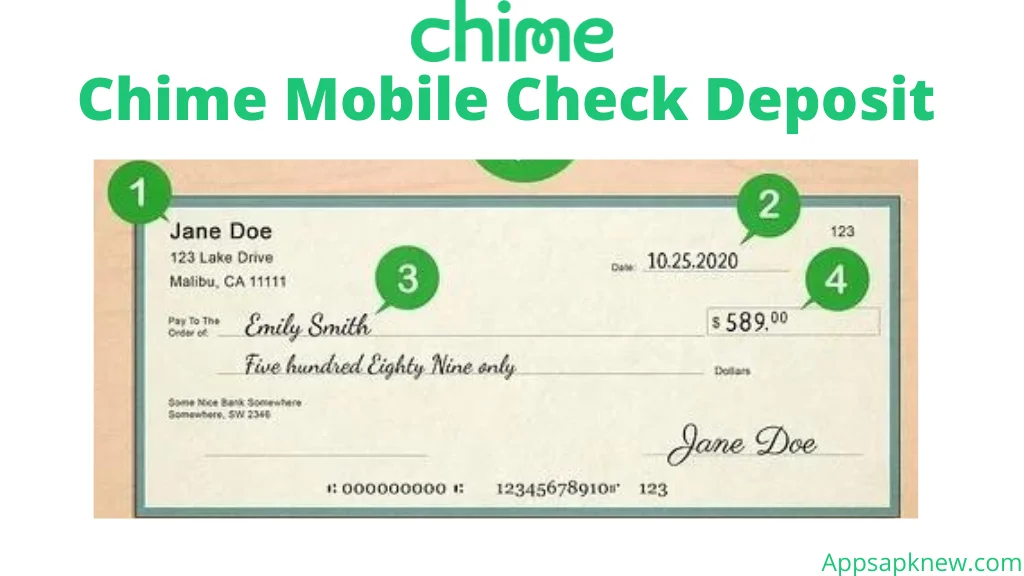

To send a check using the Deposit Checks With Chime feature, you must upload a detailed and clear picture of a valid check. After scanning, you will be able to transfer funds to your bank account.

Follow the simple steps below. We try to make things easy.

Open the Chime

- To get started, open the Chime app on your mobile device. You can use any mobile device, be it Android or iOS.

- Both devices have the same steps.

Select the “Money Transfer” icon

- After opening the program, you will find yourself on the main page of the Chime program. There, under the program, you will see the “Send money” option.

- The symbol has two arrows pointing in opposite directions. You can find it on the left side of the Chime home page app icon.

Select the “Add Fund” option

- You will find additional options by selecting the “Send Money” tab.

- There you have to select “Add Fund.

Click Mobile Check Deposit

- Finally, select the Chime Mobile Check Deposit option. This is what the camera icon contains.

- This will initiate the check deposit from Chime Mobile.

- However, there is still a lot to do; Go to the next step.

Choose Account Type

- The account type will be asked first. You need to choose the type of Chime account you want to share the money with. (Test or memory).

Enter the Amount

- Finally, you will be asked for the quantity. Write down how much money was written on the check.

Verify Self Certification

- After entering the amount, you will need to sign the back of the check. This is a way of self-validating a check.

- You must enter “mobile deposit” or “remote deposit” under your signature. This is a way to help the Chime team verify and check.

Verify the Picture

- Now, finally, take a picture of both sides of the check. Make sure you take pictures in a bright room. The details of the audit should be clearly visible.

- If Chime has difficulty reading the above descriptions, the test may be delayed or worse, rejected.

- So be very careful while taking pictures. Use a phone with a good camera. The team didn’t hesitate to dismiss the vague and straightforward image of the check.

Upload the Image

- After the photo is taken, it should be checked one last time whether there is a problem. You can take another photo if you want.

- Download when ready.

All you have to do is wait for the test. You will receive an email notification or a pop-up notification.

For More Information:

How to Put Money on Chime Card

Transfer Money to Friends With Chime

How to Get a Chime Bank Statement

Chime Credit Builder

How Long does it Take Chime to Deposit a Check?

Most customers check their payment time through Chime. Well, it takes about 24 hours to send a check to Chime. It doesn’t matter if the check is a third-party check. You must wait up to 24 hours to verify that your money has been deposited in the bank.

Sometimes it may take extra time to check and submit a check deposited on weekends or holidays.

Before you ask, we can tell you that Chime will confirm the check-in in a few hours. Therefore, the Chime team will let you know if your check is declined.

How Do I Know if My Check Can Deposit?

- Mobile check is available for any check:

- In the US, only you get dollars.

- No changes, invalid products, or duplicate codes.

- Do not pass to another company.

- Income from US financial institutions.

- For the last 6 months.

- Not a digital clone.

- Not developed remotely (ie a check issued by the seller using the current account number of the buyer but without the original signature of the buyer).

- Cannot be used to make mobile checks:

- Remittance.

- Traveler’s cheques.

- Savings bonds.

- Items that cannot be discussed, such as a letter of promise.

- Enable tool control or management.

- Instructions.

Can Chime Deposit Checks With Chime Personal Checks?

Yes, Chime can send personal checks. This is also easy to do, especially if you use a mobile check on your phone. I will show you how to make a check to your Chime account.

Can I Deposit Checks With Chime to a Third Party?

Yes, you can deposit third-party checks into your Chime account. If you are trying to deposit a Perkie check or someone is sending a check to your Chime account, you can do so on one condition.

For those who don’t know, a third-party check is one that is not paid to you directly, and the author of the check is authorized by a third party.

When a third party issues a check to someone and credits it to their account, the owner must sign the reverse side of the check. Yes, the check holder must sign an agreement to deposit the check into your Chime Bank account.

How to Deposit a Check to Chime (step by step)

Open the Chime app on your phone to deposit checks with your Chime account. Please note that checks cannot be made using the Chime website. To unlock the mobile check feature, you need to set up a deposit directly in your account. If not, then, unfortunately, no luck.

Now that you have the Chime app open, follow these steps:

- Use the program to go to the “Move Money” section.

- Click ‘Mobile Check Deposit.

- Select the type of check you made; Based on this. Treasury, wages, etc.

- Select an account (check or savings) to make a check.

- Next, you need to enter the check amount.

- You need to take pictures on both sides of the check.

- After taking a picture of the check on your device, see the details of the deposit.

It is important to take clear pictures on both sides of the lens when shooting. By doing this, you will be able to avoid the unpleasant stage of restoring the chimney if something goes wrong with the image quality or lighting.

Can I Get a Cancellation Check From Chime?

Yes, you can cancel a check from Chim. “Voice check” means a check that cannot be used to make payments from your account. Checks are easy to clean, all you have to do is write “VOID” on the front with a pen or marker.

When writing “VOID” on the check, remember not to overwrite the route number or bank account number below. These numbers are required to send or receive payments