How to avoid cash app scam

Mobile payment applications are a convenient way to collect money using a smartphone. These applications have become very popular-cash app scammers will try to use them to steal your money. Learn how mobile payment app scams work and how to avoid remittances to clear serious payment applications.

As part of the fraud, customers must use cash applications to pay utility bills to protect their services.

Not only does JEA accept cash applications for payment, but the city facility also eliminates the impact of energy and water shortages caused by the COVID-19 issue.

In cash app scams the Customers do not need to prepay debit cards by phone or contact banks, credit cards, or other financial information.

In addition, in order to help users respond to COVID-19, JEA has also done the following work:

Late fees will be delayed until further notice

Next month, customers paying with Visa, MasterCard or Discover will have higher credit card prices

How about mobile payment applications

You may have heard of mobile payment applications such as Venmo, Money App, or Zelle, which allow you to send and receive funds from your smartphone. If you don’t use it, please follow the steps below.

To use the mobile payment application, you need to create a payment. You may wish to send the payment card directly to your bank or credit card.

After creating an account, you can use the app to pay at certain stores.

You can also send money to someone you know-just make sure to send the money to the right person. View their email address, phone number, or username.

People can also use the cash app to pay you. When someone pays you, the money wo n’t go into your account. Instead, it will appear in your account balance. You can decide where to ask for money. You can

Enter the amount in your mobile payment number

Send this account to other application users

Send money to your bank

How not to send money to a professional

Over the years, scammers have invented various myths to attract people to send money to them. They can lie to you and tell you

You have won a bonus or interest and must pay to receive it

Your loved ones are in trouble and they want you to send money

You owe the IRS

It comes from raising awareness that you need money to solve problems in your computer

Want your money to be the benefit of love

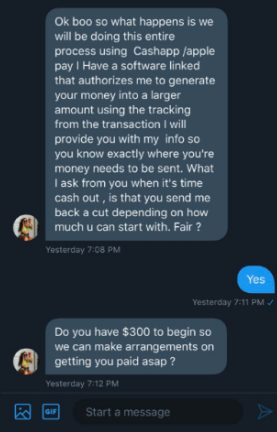

The demand curve pays off quickly, which makes it difficult for you to recover your funds. To do this, they will ask you to change or use a credit or gift card to pay. It is estimated that you will be required to send money via mobile payment service. If you receive an email or an unexpected message requesting you to send money, please do not click any links. Log in to the application to see if there are any funding requirements. If not, the email or text may be a scam

What if I send money to a prank

If you have transferred money to the prankster, please report fraud to the mobile payment website and ask them to cancel the transaction immediately.

Then notify FTC. When you report the cash app scam/fraud, FTC can use this information to create information against fraudsters.

Detect and report fraud

If you receive suspicious messages from social networks, emails, text messages, or phone calls related to the cash application, or see phone numbers that you think are illegal, contact support to report the incident. The Cash app will check and take action if necessary. Please note that there are currently no phone numbers that can be used to call through the cassette

What is phishing -?

This is an attempt by fraudulent representatives to collect personal and/or financial information through social networks, email, phone, or text messages. Sometimes victims of phishing cash app scam are instructed to enter their information on fake websites that impersonate real websites.

Protecting Confidential Information None of the cash representatives will ask you to enter the login code on the phone, on social networks, or on any other medium. If you consider yourself a victim of fraud, immediately change the cash withdrawal PIN and report it.

This is an application that many of us use to send money, but scammers can use it as another way to trick you: Cash Cash, which is a mobile payment service.

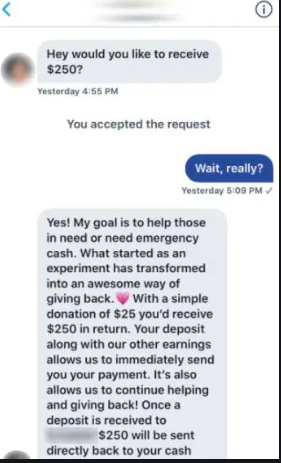

Troubleshooters alert you to money fraud

Fraudsters target users with weak cash apps on Twitter and Instagram through fake requests, funding fluctuations, and recommendations for mobile apps, while YouTube videos help people who fake money. This is what you need to know.

Since the area first appeared at the end of 2013, the most popular area application for personal payments (P2P) Cache has been growing steadily. The growth of services is supported by advertising marketing campaigns that provide cash gifts to people dealing with the brand on many social networks. The success of these updates, in turn, inspired an army of scammers who used various negative factors to separate social network users from their sensible means.

Looking at these numbers, it’s easy to see why Cash is a promising target for scammers. ACCORDING to a Market Watch article it was published in August 2019, the 2.4 cash application received a million downloads in July 2019. The same article indicated that since the release in 2013, the Cash application has been downloaded 59.8 million times, and its largest competitor, Venmo, 52.7 million times.

His two-part series talks about what I discovered when I looked for these scammers from July 2019 to September 2019. The purpose of this study is. Do not give an exhaustive overview of all these frauds, but analyze the behavioral trends of a group of scammers who know and are interested in specific applications.

In the first part, I will explain how growing money apps attract opportunistic scammers and how they work on Twitter and Instagram. In the second part, I will provide more detailed information about the strategy used by the Cash App scammer on Instagram, as well as watch videos posted on YouTube. YouTube declares that this video is provided “for free” and “Hacker” way. In addition, I give tips and suggestions on how to avoid fraudulent P2P payments.

How to file a complaint

No matter what your claim for Cash is, follow the three steps below to get the best possible claim.

1. Click the “Complaint button about application file”.

2. Describe your complaint in detail and suggest how critical applications should be resolved.

3. Submit a complaint in the form of a cash application and indicate.

You can try to file a complaint, but it is likely that the prankster transferred funds from CashApp and “burned” the account, and the money will never be used again.

As others have noticed, such as Western Union or Venmo, it is better to use these services to transfer funds for services that have been received, or between people who know each other.