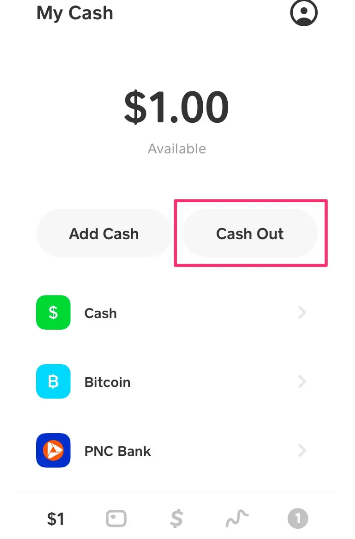

To Cash Out funds from your Cash App to your bank account:

1. On the main screen of the Cash app, click the Balance tab.

2. Click Cash Out.

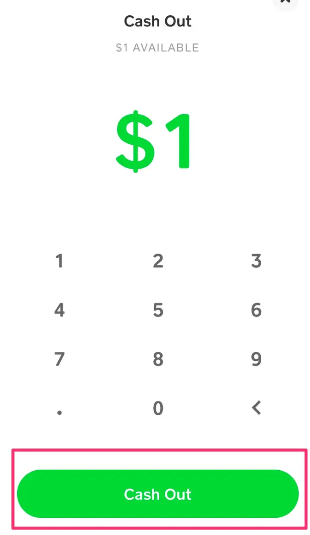

3. Say the amount and click Withdraw.

4. Choose a storage speed

5. Verify the use of your PIN or contact ID.

The withdrawal procedure cash app cash out

To withdraw amount from the Cash application to a bank account:

1. Click the [Balance] tab on the main screen of the cash app

2. The withdrawal of the press

3. Select the amount and click to withdraw

4. Choose archiving speed

5. Confirm with a PIN or Touch ID

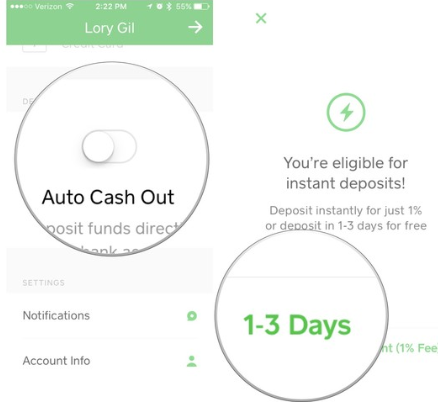

How to activate the automatic collection of Cash out from the app

If you use Square Cash, this is the easiest way to send and receive money. The automatic deletion function is in the settings section.

1. Run the Cash app on the iPhone.

2. Click on the profile in the top left.

3. Scroll down to activate auto delete.

4. Choose from Instant Deposit (1% fee) or 1-3 days (free).

If you change your mind, you can disable and disable call forwarding by following the same steps.

How to withdraw money from the cash app and send the money to your bank account immediately

In order to “withdraw” using the “cash” application, you only need to transfer your application balance to the linked bank account.

If you’re not familiar with Square’s Cash App, you can use peer-to-peer payment apps like Venmo to collect payments with your family and friends, even if you’re not in the same room.

Here is how to benefit from using the cash app:

Square Cash is similar to Venmo’s Peer-to-Peer app. Even if you don’t have the money or the same amount, you can send and receive money with friends and family. Ideal for breaking bills, snacks, and eating.

When someone sends money through the Cash app, they live in the app. If you have a Square Cash Card, you can use it as a debit card and use the balance wherever the visa is accepted.

However, if you don’t have a credit card, or want to transfer the balance to your bank account, this is very simple and you can do it right away.

How to exchange in cash app cash out

1. Open the cash app on your iPhone mobile or Android mobile.

2. Click the amount in the center of the screen to go to the My Cash tab.

3. Click the Use button on the left under Credits.

4. The Cash Exchange menu is displayed and all transfer balances are automatically selected. If you want to reduce the amount sent, please enter the amount using the touch screen of your iPhone or Android device.

5. After confirming the transfer amount, click “Refund” below.

A pop-up will appear asking you how to save money. If you choose Standard, it will take about 1 to 3 days for the money to appear in your account. If you need the money right away, you can click “now” to claim 25 cents.

Cash out: What is Cash and How is It Used?

Cash apps will now provide routing and account numbers, allowing customers to deposit incentive checks directly into their app’s cash balance. If you didn’t file a tax return last year, you can enter this account information on the IRS website.

To view your account and route number, you need to activate your free cash card from your cash app. The physical card must arrive within 10 business days, but the customer can immediately add the cash card to Google or Apple Pay to order or cash using the card details in the cash card tab of the app. You can start using the card. The money held by Cash App is not covered by the Federal Deposit Insurance Corporation, so if the company goes bankrupt, that person will not be covered.

As more people accept the convenience of non-cash payments, technology companies are making it easier to send and receive money from smartphones. One of these services is that cash apps have become more popular compared to other conversion options and offer unique features such as equity investments, receiving special savings from “cash consolidations” and more. Is that. Buy and sell bitcoins

Read on to read more about cash, features, pros, and cons use.