Cash App and Venmo: Introduction

About cash application

Cash App, a subsidiary of Square Inc. The little green logo you know today is Venmo’s biggest competitor. When FENMO is the leading platform for transferring funds, few people rely on cash applications. The efficiency and ease of use of the cash application took some time.

About Venmo

Venmo was founded in 2009 as a subsidiary of PayPal. If you don’t know, Elon Musk is the founder of PayPal. You can tell that Venmo was so successful that it started to expand the Cash application user base without much competition.

A Square Cash app and Venmo: Which one suits you best?

To pay for a friend’s pizza or concert ticket, pay the seller, or pay money to a family member, you need to know how to transfer money to someone when there is no money in your wallet. Today’s P2P payments can pay anyone for a simple app (like the Venmo or Cash app, formerly known as Square Cash).

Although there are many similarities between the two applications, there are significant differences. Try these Venmo Cash details so you can choose the best P2P payment app.

Venmo Review: careful observation

You can send money through the mobile payment app via email or phone number using the Cash app and Venmo. In addition, Venmo allows users to send or request payments via iMessage.

If you do not use a credit card for transactions, the application and registration are free and funds can be sent and received. By using a credit card as a linked account, you charge a 3% Venmo fee for each transaction.

The main difference between my P2P apps is that Venmo is a small social network – a payment method like Instagram. You can send funny messages and emoji icons for a fee and you can also see the activities of your friends. Similarly, you can choose to view payments from public sources or keep transactions confidential.

Examination of the demand for money: a detailed observation

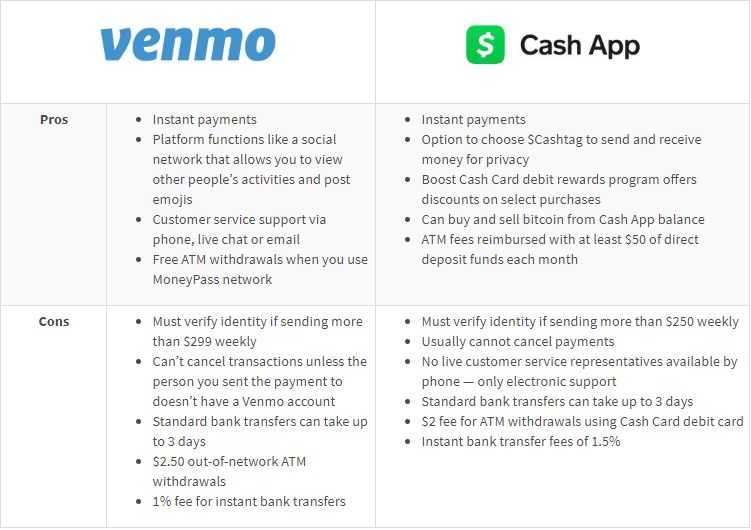

If you’re not in a Venmo-compatible social environment, you can choose the Cash app because it’s easier. Compared to Venmo, money provides more anonymity because you can use $ Cashtags to send and receive money. Imagine $ Cashtag as your unique display name. Users with or without the app’s cash account can use their cash sign to cover their expenses and use it to pay others.

In addition, while the Venmo and Cash app offer discount cards, the Cash Cash app also offers the Cash App Boost app, which can offer instant discounts at restaurants and cafes. Another feature offered by the Cash app in the Venmo app is the ability to enter a salary directly into the Cash app, if you have an active payment card. If you buy or sell bitcoins, the cash app allows you to do so from your cash balance, and you can spend your income on a free Visa debit card.

cash app and Venmo Review

Cash app and Venmo: customer service

Cash does not provide a toll-free number, but you can call 855-351-2274 to listen to the automatic instructions. Users can also apply for the Cash application by selecting the “Contact Support” option in the Cash application or through cash.app/help.

Unlike the cash app and Venmo provides a phone number of 855-812-4430, so users can talk to direct customers at 10:00. Until 18:00 on weekdays. Users can also chat with support agents starting at 7:00 on weekdays. 13:00 EST and 9:00 on weekends. In the EST-Venmo app or through the Venmo Help Center, you can send up to 11:00 by email.

What are the disadvantages of Cash App and Venmo?

When it comes to the flaws of these applications, this is very difficult. I like these two platforms. As an everyday investor and trader, my thinking may be biased, but this is how I feel in each application.

Disadvantages of critical applications

If you use a debit card to withdraw cash from the ATM, the fee is $ 2. Regarding the cash application fee, we recommend choosing your bank and withdrawing cash from it.

When sending money with a debit card, the subscription fee is 3%.

If you wish to withdraw funds to your bank account immediately, the fee will be 1.5% of the total transaction amount.

If you buy or sell Bitcoin, the cost is high.

If you want to send money to your bank for free, it will take about 1-3 working days.

Venmo’s disadvantages

Like the Cash app, Venmo charges a 3% fee when sending credit cards. The Venmo fee is the same as the cash requirement fee.

Immediate transfer to your bank requires payment of 1% of Venmo fees.

The minimum fee is $ 0.25, which makes AppMax exceed Venmo. If you withdraw 1 USD, you will lose 0.25 USD instead of 1%.

If you withdraw money from an ATM machine, the cash withdrawal fee is $ 2.50.

Requesting to transfer free shipping usually takes 1-3 business days.

After overcoming the pros and cons of Cash vs Venmo, you can see that everyone has their own advantages. You can also see why Cash became Venmo’s main competitor in such a short time. Many people still use Venmo because it is basically the main platform. However, with other features of the Cash application and competitive fees, users began to pay attention to the Cash application.

Cash and Venmo applications: sending and receiving restrictions

On both P2P payment systems, the amount you can only pay and receive initially is limited. When you open your account, Venmo will limit the amount you can send and receive to $ 299.99 per week before verifying your identity. It collects the application name, actual address, date of birth and social security number to verify your identity and compares the information with the data collected from the national database. Once verified, the weekly limit for remittances is $ 2,999.99, and the separate limit for merchant payments and Venmo card transactions is $ 2,000.

If you send more than $ 250 in cash each week, the cash will require you to verify the ID number, date of birth and the last four digits. When you receive money, if you receive more than $ 1,000 in cash within 30 days, Cash will ask you to verify your identity.

Is Venmo safe? Are you making a cash request?

Like most influential companies in the financial technology world, Venmo, Cash App, and Zelle face security challenges in this process. With that in mind, all of the app designers have taken steps to fix these early issues, so the Consumer Report recently assessed its usage. From data encryption and verification of purchases to multi-factor authentication and fraud prevention, each major payment application offers sufficient security features to protect your financial data. Peer-to-peer safety control is beyond imagination.

As part of the review, Consumer Reports offers the following tips to maximize the security of your digital transactions:

Use these apps only with trusted friends and family.

Define additional security. Be sure to subscribe to enable PIN verification or fingerprinting.

Please make sure all the recipient details are correct. The application server will not refund money sent to the wrong recipient.

Peer-to-peer payments are not used for commercial purposes.

Before using the app, learn the information and steps to contact the app’s customer service.

Keep your app up to date. Older versions are more vulnerable to hackers.

Frequently Asked Questions

Do you need a bank to pay a cash app and Venmo?

When you create an account for the first time, you may receive payments from other people. The problem is that without a bank account, you cannot withdraw money. The solution is to request a debit card via Venmo or Cash App, which requires a social security number.

Can I delete the cash app and Venmo transaction records?

For Venmo recordings, people around the world, including friends, can see it. The transaction history cannot be deleted, but the transaction can be made private by defining.

Is Venmo or Cash better?

I think Venmo has better customer support than a near-zero cash app, but the two are the same. What I do know is that whenever a payment application is suspected of violating the terms of use in any way, it will close the account. Venmo has more users. This is probably because it is longer than the Cash app. There is a lot of money that Venmo hates, like buying stocks and bitcoins.

Can I send money from Venmo to the Cash app?

Some studies seem to be able to connect Cash or Venmo cards to other platforms. There is no other way to publish directly to another platform. Another way is to withdraw money from the bank from any platform and add it to any platform. I don’t know why I often ask this question, but there are two ways to think about it.