In the event that your ATM card is lost, stolen, or you notice suspicious activity in your account, it’s crucial to act quickly. Here’s how to block your ATM card and account at First Bank immediately:

Contact Customer Service

Online Banking Option

Visit a Branch

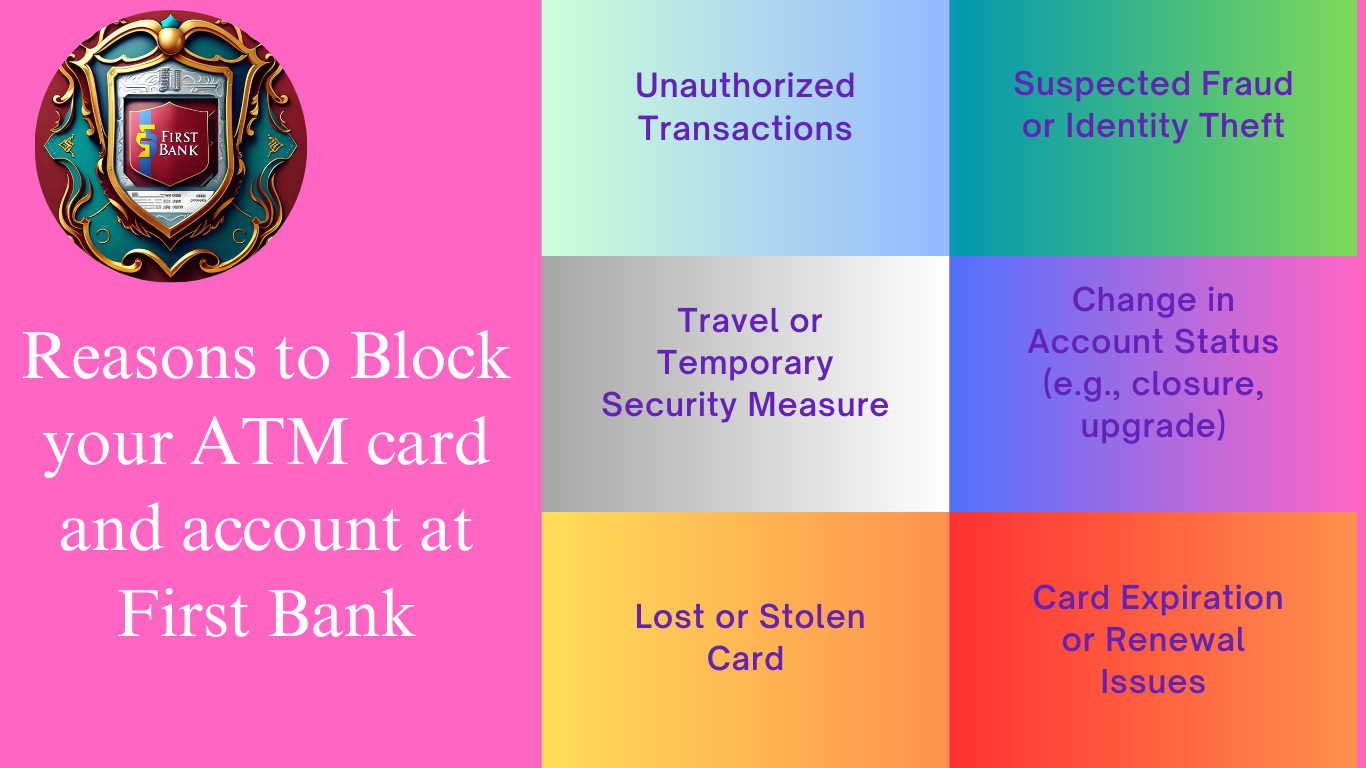

Blocking the account or ATM card is a precautionary measure to secure finances and personal information. Here are specific reasons someone might need to block their bank account or ATM card;

Lost or Stolen Card: If a card is lost or stolen, blocking it prevents unauthorized transactions.

Suspicious Activity: Noticing unusual transactions may prompt someone to block their card or bank account to protect their funds.

Identity Theft: If there’s a concern that personal information has been compromised, blocking accounts can help mitigate potential fraud.

Card Damage: A damaged card may not function properly, necessitating a block and replacement.

Traveling: Sometimes, individuals block their cards when traveling to prevent misuse in case of loss.

Block your ATM card and account at First Bank

How to Block your ATM card and account at First Bank Immediately

Block your ATM Card and account is a crucial step to protect your finance from unauthorized access. You can choose any method from given options .

Blocking via USSD code

First Bank has made it easy to block your account or ATM card using a USSD code, so you don’t need internet access.

• Just dial *894*911# from any mobile phone. You’ll be prompted to enter the phone number linked to your First Bank account to complete the block request.

This service is quick and efficient, ensuring your account and card are secured from unauthorized access right away.

Contact customer service

A trustworthy way to contact First Bank is to reach out to their customer service directly.

• You can call their dedicated customer service numbers at +234 708 062 5000 or +234 1 448 5500, which are available 24/7.

• Alternatively, you can email firstcontact@firstbanknigeria.com, explaining your situation and requesting the blocking of your account or ATM card.

• You can also use social media, like Twitter, to connect with First Bank’s customer service for help.

Visit your nearest branch

If you’d rather handle things in person or need more assistance, visiting a First Bank branch is a good option.

1. You can talk directly with a bank representative about your concerns and request to block your account or ATM card.

2. Just make sure to bring a valid ID with you, as you’ll need it for any account-related requests.

Block First Bank ATM Card

If you need to block your ATM card, First Bank has some straightforward options to help you.

1. You can use the USSD code *894*911# specifically for blocking your ATM card.

2. Alternatively, if you prefer using your smartphone, the First Bank Mobile App allows you to go to the card management section and easily block your card from there.

Choose whichever method works best for you!

First Bank of Nigeria stands out for its customer-centric approach, innovative digital solutions, and commitment to financial inclusion. With a focus on comprehensive financial services and support for SMEs, it continues to play a vital role in the economic development of Nigeria. As it embraces new technologies and sustainability initiatives, First Bank remains a trusted choice for individuals and businesses seeking reliable banking services.

Conclusion

Being proactive in managing your ATM card and bank account security is essential. First Bank of Nigeria offers multiple avenues to Block your ATM card and account at First Bank , ensuring that your finances are protected. Always monitor your accounts regularly and report any suspicious activity immediately to safeguard your assets.