Block Access Bank Account and ATM Card

In today’s digital age, safeguarding your financial assets is more crucial than ever. Losing access to your bank account or ATM card can expose you to potential fraud, unauthorized transactions, and financial distress. Access Bank understands the importance of security and provides various options for customers to Block Access Bank account and ATM card quickly and efficiently. Whether you’ve misplaced your ATM card, suspect fraudulent activity, or simply wish to secure your account, knowing how to take prompt action can save you from significant losses.

With easy access to customer service and online banking options, you can act swiftly to protect your assets. By following these procedures, you’ll gain peace of mind knowing that your information is secure, allowing you to focus on your day-to-day activities without worry.

Understanding the Need to Block Access Bank Account and ATM Card

In today’s fast-paced world, losing your ATM card or experiencing suspected fraud can happen in an instant, making it necessary to know how to Block Access Bank Account and ATM Card. Common scenarios for blocking include misplacing your card, theft, or noticing unauthorized transactions on your account. Each situation presents unique risks; delaying action can lead to significant financial losses or identity theft.

The emotional toll can be just as severe, causing anxiety and stress as you worry about your finances. The thought of someone else accessing your hard-earned money can be overwhelming. By taking swift action to block your account or card, you protect not only your finances but also your peace of mind. Understanding these potential risks reinforces the importance of knowing how to secure your account quickly and efficiently.

Immediate Steps to Take

When you realize your Access Bank ATM card is missing or you suspect fraud, the first step is to assess the situation. Determine whether your card is truly lost or stolen by retracing your steps. Check your pockets, bags, and any recent locations where you might have used it. If you still can’t find it, it’s crucial to verify any unauthorized transactions on your account.

Log into your online banking or mobile app to review your recent activity; this will help you identify any suspicious charges that need to be reported. Next, gather the necessary information before contacting customer service or taking further action. Have your account details handy, including your account number and any identification documents, as these will be essential for verification. It’s also helpful to compile a list of recent transactions, as this can expedite the process when you report any unauthorized activities. By taking these immediate steps, you’ll ensure that you’re prepared to act quickly.

How to Block Access Bank Account and ATM Card:

Use the USSD code to Block Access Bank account

USSD code is a short message service a advance update for customers .So, they can easily approach customers services given by Access Bank .

Follow these steps to block Access Bank account;

• Just dial 901911# from mobile phone.

• Read the prompt carefully and act accordingly and enter your phone number linked to the account and your USSD banking PIN to confirm the block.

This way your bank account immediately lock and no further transaction will proceed.

Visit a Access Bank nearby branch

There can be many reason to personally visit Access Bank nearby branch. It can help more precisely for safety of your finances. Speak to a customer service representative. Explain the situation and request to block your account because of suspected fraud or loss of your banking tools.

Note:. Remember to bring a valid ID for verification.

Blocking your ATM card Using Access Bank services

If your ATM card is lost or misplaced, blocking your ATM card is crucial step .You can get free assistance by these methods.

Follow these instructions and act quickly to prevent unauthorized transactions from your bank account.

Use USSD Code

• Dial USSD code *901# .

• Act according to appears instruction on mobile screen .It allows you to block your ATM card anywhere, anytime.

Contact customer service

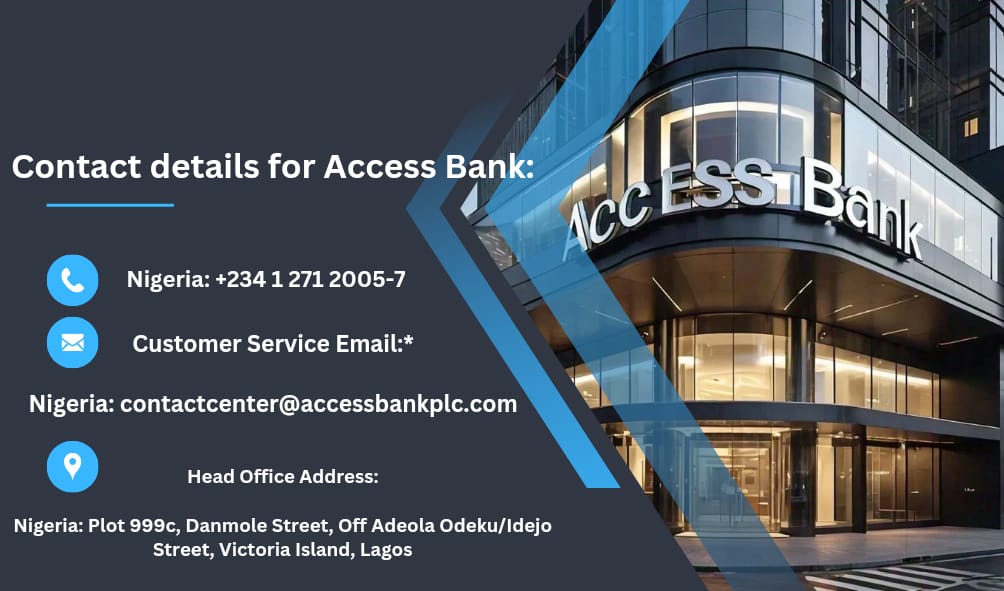

You can Block Access Bank Account and ATM Card by making Call customer service

• Dialing on 0700CallAccess ( 07003000000, 01-2802500, 01-2712005-7)

Or

visiting a branch works for blocking your ATM card is also another option to block your ATM Card.

Use Access Bank’s mobile app to block ATM card

• Access bank mobile app also has a feature that can help you to block your ATM card directly from your phone.

• Navigate the menu and send request to block your ATM card instantly.

Now, your ATM card doesn’t function for any transactions from anywhere to prevent unauthorized approach to your bank account.

Conclusion

In summary, acting quickly to block your Access Bank account or ATM card is crucial in protecting your finances from potential fraud and theft. Familiarizing yourself with Access Bank’s security features, such as mobile banking and customer support options, can empower you to respond effectively in emergencies. Remember, proactive measures are key to maintaining your financial security. By staying informed and vigilant, you can safeguard your assets and enjoy peace of mind. Always prioritize quick action whenever you suspect any irregularities to ensure your financial well-being remains intact.

FAQs

How can I block Access Bank ATM card ?

You can block your ATM card by contacting Access Bank’s customer service, using the mobile app, or accessing your online banking account.

How to protect my account if I notice unauthorized transactions?

Immediately block your card and report the transactions to customer service for further investigation.

Can I temporarily block my card?

Yes, the Access Bank mobile app allows you to temporarily block your card, which can be useful if you think you may find it.

How long does it take to receive a replacement card?

Replacement cards typically take a few business days to arrive, depending on the bank’s processing times.

Tips for Preventing Future Issues

- Use Strong Passwords: Ensure that your online banking accounts have complex, unique passwords.

- Enable Alerts: Set up transaction alerts to monitor your account activity in real time.

- Be Cautious with Personal Information: Avoid sharing sensitive information over the phone or online unless you are certain of the recipient’s identity.

- Keep Track of Your Card: Regularly check your wallet or bag to ensure your card is in place.