What Is Zelle?

Zelle Work is a mobile payment application that enables peer-to-peer (P2P) cash transfers, simplifying the payment process and facilitating cash transfers without holding cash or going to the bank. Customers using Zelle shipped $187 billion in 2019. 57%. 2018.

Zelle is made by more than 30 major American companies. It has a standalone bank and app that users can download to their smartphones. This service is integrated with mobile banking applications from major partner banks such as Bank of America, Chase, Citi, and Wells Fargo. Those who already have their own mobile app can start using Zelle now.

How Does Zelle work?

With Zelle Work, you can transfer money directly from your bank account to someone else’s bank account. No fee. It usually takes a few minutes to transfer funds between accounts

If your bank or credit union offers Zelle, you can register an existing Zelle bank account online or from your financial institution’s mobile app. If your bank doesn’t yet offer Zelle, you can still use it by downloading and subscribing to the Zelle mobile app.

Here’s How to Use Zelle:

1. Decide Who You want to Pay with Zelle

Zelle work is great for sending payments to people you know and trusts, such as friends and family. For example, if you went out to dinner with a friend and want a refund for your meal, you can send it using Zelle. Donate $50 to a service provider who works regularly, such as a babysitter, or a friend who may continue to use Zelle in a small business. Herbal Care Specialist or Cosmetologist

2. Check if your Bank or Credit Union Offers Zelle.

In this case, register Zelle using the website or mobile app. If your financial institution offers Zelle, it will usually appear as an option under the Forwarding menu in your app or website. Otherwise, you can download the Zelle app and sign up for your Zelle account there.

3. Get your friend’s Email Address or Phone Number.

You can use Zelle to send money to anyone with US citizenship. All you need in a bank account or credit union is your current email address or a US email address. Phone number. make sure the spelling is correct.

4. Decide How Much to Spend

Banks and credit unions have many limits on how much money you can send with Zelle. If your bank or credit union does not offer Zelle services and you need to use the Zelle app, you will be limited to sending $500 per week via the Zelle app. Zelle is suitable for small and fast payments. If you want to spend more money, you can choose another payment option.

5. Send Money

If a friend or family member signs up for Zelle, the money will be credited directly to your bank account within minutes. If you are not registered with Zelle, you will receive a text message or email explaining your payment method. You do not need to enter your bank account details. Zelle work transfers funds from one financial institution to another.

What is Zelle’s transfer limit?

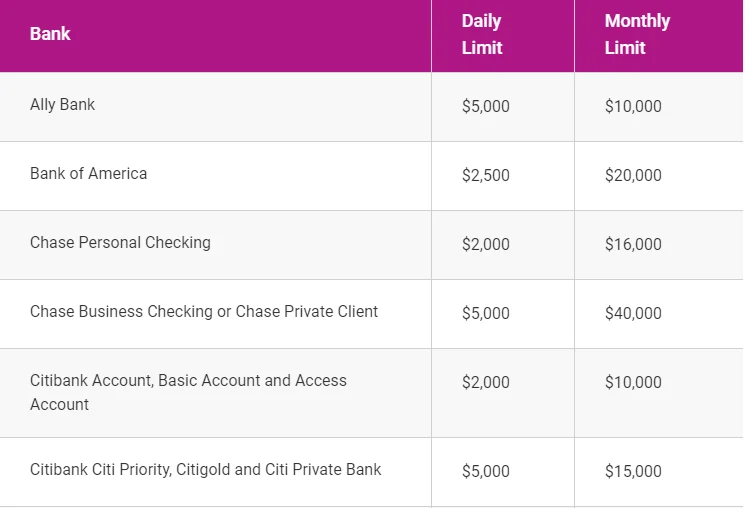

Check with your bank or credit union the amount you can send to Zelle. Different banks may have different limits on sending or receiving. As an example:

Bank of America wants its customers to keep Zelle’s daily remittance limit within $3,500. It can be sent to anyone.

The Chase Individual Checking Account allows customers to transfer up to $2,000 per day and up to 2,000 els per Zelle transaction. In addition, Zelle’s remittance limit will be higher for individual/private bank customers or business accounts.

Wells Fargo Zelle allows users to set a transfer limit of $3,500 per day. New Zelle users may have less bonding.

If your financial institution doesn’t offer Zelle, you can use the Zelle app to send up to $500 per week.

Which Banks use Zelle?

Zelle is compatible with almost all major banks. Most of them are served through mobile banking applications. Users who download Zelle’s unique app must provide a phone number or email and debit card information to send and receive money.

If you have a Visa or MasterCard debit card, you can download Zelle and send money using the app. If the bank is already working with Zelle, you will be directed to the bank’s mobile app. Until you download the app to your device.

See this list for a complete list of banks that Zelle works with.

What does Zelle charge a Fee?

Unlike other P2P forwarding services, Zelle does not charge a fee, but Venmo and Cashapp do so when customers send money via credit card.