Opay

Recently, Opay is becoming popular choice as a digital banking app for users doing transactions because of its excellent features like quick transfer money, Cashback because of introducing high tech technology know as Opay USSD code.. Additionally, it is easy to used by POS agents. Opay is easy to deal unlike other digital banking apps where you need to fulfill many registration requirements before going to use Opay USSD Code. This article will give you understanding of USSD code and how it works for online banking.

Note: It is necessary to have an active online Opay account with registered phone to use USSD code in Opay app.

What is Opay USSD Code?

The Opay USSD Code is a cornerstone that enables users to access a broad array of financial services without internet connection. By using it you can make quick transactions, bill payment and more directly from your mobile by sitting at your seat .The evolution of Opay USSD Code enables everyone to access financial services anywhere.

Create an Opay account

Do you have an Opay account? Let me guide you step by step how to make Opay account on your phone. Just like other digital apps you need to download an Opay account from play store or app store.

Then, follow these steps :

- Go to play store or app store and install an Opay app(For IOS users ,you will see Get app.

- After installation of app.

- Open Opay app and click on sign up.

- Enter your phone number and password.

- Click on ‘Create Account ‘.

- You will a verification code via sms

- Copy that code and put into app.

- Provide your name and Date of birth.

- Click on ‘click Account’.

- Your Opay account is ready to use.

Advantages of using USSD Code with Opay account

- Accessibility: It can work on any mobile without using internet.

- Easy to use: It works on easy and simple commands.

- Secure system: Users can make trustable transactions with their personal PIN.

- Versatility: A wide range of financial services are available at your fingertips.

- Rewards: Opay gives many offers including Cashback on airtime ,data purchase and interest on savings .

How to add money at your Opay account with USSD code?

Funding your Opay account is straightforward.

- Open your account in your phone.

- Access the menu in opay banking app .

- Put the USSD Code in it.

- Select “ Add money”.

- Choose bank transfer or card funding.

- Now, read appear instructions on screen and follow it to complete deposit.

Money transfer with Opay account USSD Code

You can send money with Opay account by using USSD Code. It is crafted as convenient for everyone.

- Open your online account in your phone.

- Dial your USSD Code and select ‘send money’.

- Input receipt details and amount.

- Confirm with PIN for secure transactions.

- Wait for confirming your payout.

You can use your Opay account for these things .

- Send and receive money

- Bill payment

- Book ride

- Order food

- Online shopping

- And more

What is USSD Code for OTP ?

USSD Code for OTP Opay is *347*010#. Follow steps help you to OTP by using USSD Code.

- Dial *347*010# on your phone.

- Enter your Opay mobile number and put Opay account password.

- An OTP will be generated and appear on your mobile screen .

- Put your OTP and press ‘Enter’.

This OTP will confirm your identity for various transactions including sending money, withdrawing money and topping up your airtime .If you don’t receive OTP you can try again.

Note: You can only generate one OTP per transaction.

Additional things to keep in mind while using Opay USSD Code

- You must need an active Opay account for use of Opay USSD Code.

- USSD Code only function with Nigerian major networks such as Airtel, MTN, 9mobile etc.

- USSD Code is not available for all transactions such as to pay for goods and services.

- USSD Code is a free service you will not charge for it.

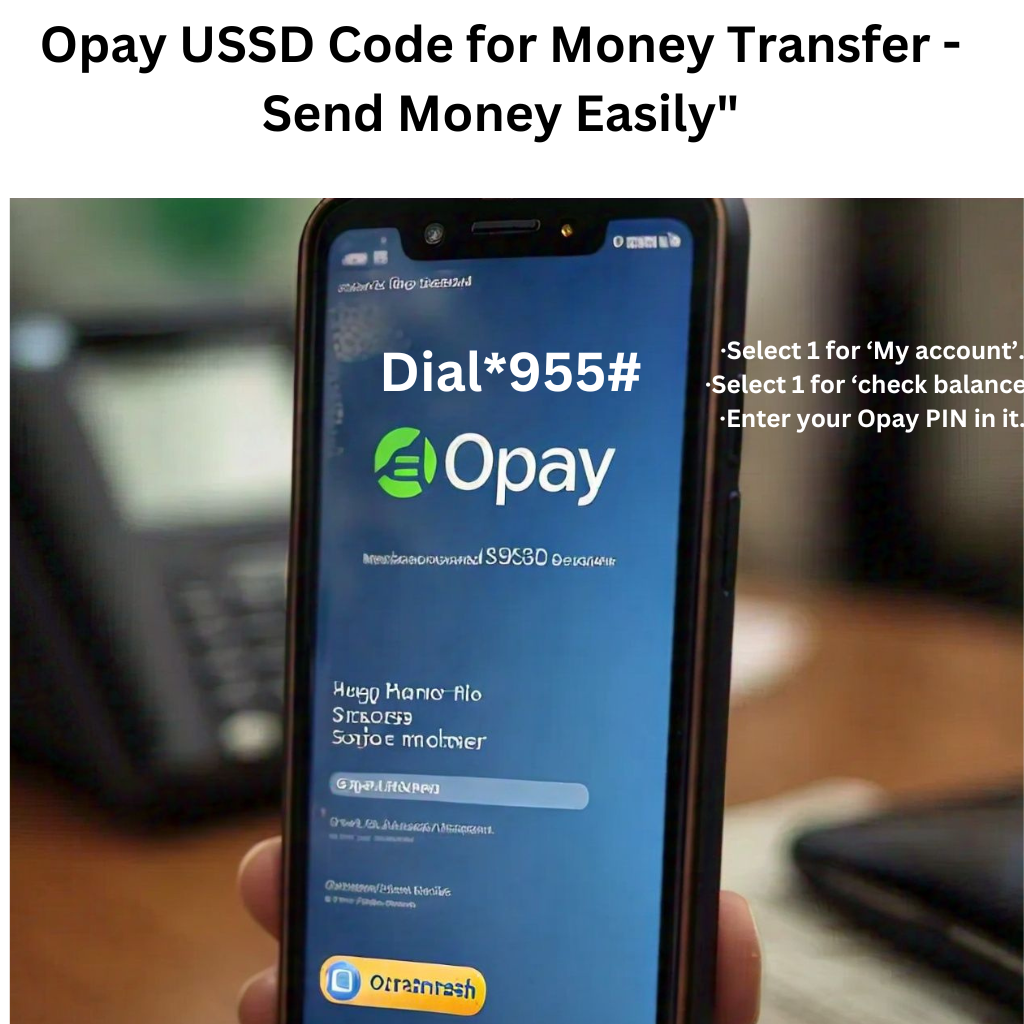

You can use USSD code for balance check

- Dial*955# on your device.

- Select 1 for ‘My account’.

- Select 1 for ‘check balance’.

- Enter your Opay PIN in it.

Your current balance will appear your mobile screen.

How to transfer money from Opay account to bank account?

Here are steps to follow for transfer of money from Opay account to local bank;

- Dial *955# using your register phone .

- Select the option “Transfer”.

- Select option 2 for transfer money to another bank.

- Now put receipt details .

- Select bank name(Access ,first bank etc )

- Put amount detail you want to transfer.

- Confirm your transaction byproviding your Opay PIN.

Opay loan USSD code

Opay is not only providing convenient way to mange your finances but also offers loan for eligible users by using *955# USSD code.But for getting loan through Opay account you must need to meet their requirements.

To access Opay loan you must be eligible for it;

- You must be Nigerian citizen.

- You must have registered Opay account.

- You must have bank verification number.

- You must have valid means of identification (National ID card, deriving license or international passport either will do).

By eligible these requirements you can use okash loan by using Opay USSD Code .

- Dial *955# by using your registered phone via registered Opay account.

- Select option ‘loan’.

- Follow prompt and apply for loan.

- Get your loan payment into your Opay account.

Remember:

The duration of okash loan is minimum is 91 days and 360 days maximum. The daily interest rate of it is 0.1%to 1% and for annual interest is between 36.9% to 360%.

Along with it you will have to pay origination fee with your loan ranging fromN1299to N6000.

Conclusion:

Opay account is a attractive way of managing finances through mobile. It offers various series such as bill payment, loan sending receiving Mobile. This product and services purpose is to make banking more convenient and affordable for Nigerians.