To effectively manage your finances, knowing how to check Zenith Bank account number is essential. This information is not just a string of digits; it’s essential for online transactions, setting up direct debits, and ensuring accurate communication with customer service. Having quick access to your account number can save you time, prevent errors, and enhance your banking experience.

Zenith Bank offers a wide range of financial services designed to meet the needs of individuals and businesses. These services include personal banking options such as savings and current accounts, loans, and credit cards.

For businesses, Zenith Bank provides corporate banking solutions, trade finance, and merchant services. Additionally, the bank features robust online and mobile banking platforms, allowing customers to manage their accounts, transfer funds, and pay bills conveniently. Zenith Bank also offers investment services, insurance products, and wealth management solutions, making it a comprehensive choice for diverse financial needs.

In this guide, we’ll outline the various methods to retrieve your account number effortlessly, empowering you to manage your finances with confidence.

Why You Need To Check Zenith Bank Account Number

Definition and Significance: An account number is a unique identifier assigned to your bank account, crucial for conducting transactions and managing your finances securely.

Structure: Zenith Bank account numbers typically consist of a combination of digits that can vary in length, often ranging from 10 to 12 digits, ensuring each account is uniquely identifiable.

Common Uses: Your account number is essential for various activities, including transferring funds, setting up direct debits, receiving payments, and verifying your identity for banking services.

Check Zenith Bank Account Number Through Zenith Bank Mobile App

Accessing your Zenith Bank account number via the mobile app is a quick and efficient process. Here’s a step-by-step guide:

- Download the App: If you haven’t already, download the Zenith Bank mobile app from the Google Play Store or Apple App Store.

- Log In: Open the app and enter your login credentials. If you don’t have an account, you can register by following the prompts.

- Navigate to Account Information: Once logged in, go to the “Accounts” section on the . This is usually prominently displayed.

- Select Your Account: Choose the specific account for which you want to check the account number.

- View Account Details: Your account number will be displayed alongside other account information such as balance and transaction history.

Benefits of Using the App: The mobile app provides instant access to your account number, making it convenient for on-the-go banking. It offers enhanced security features, quick navigation, and the ability to perform other banking tasks, such as transferring funds or paying bills, all in one place. This makes it a valuable tool for efficient financial management.

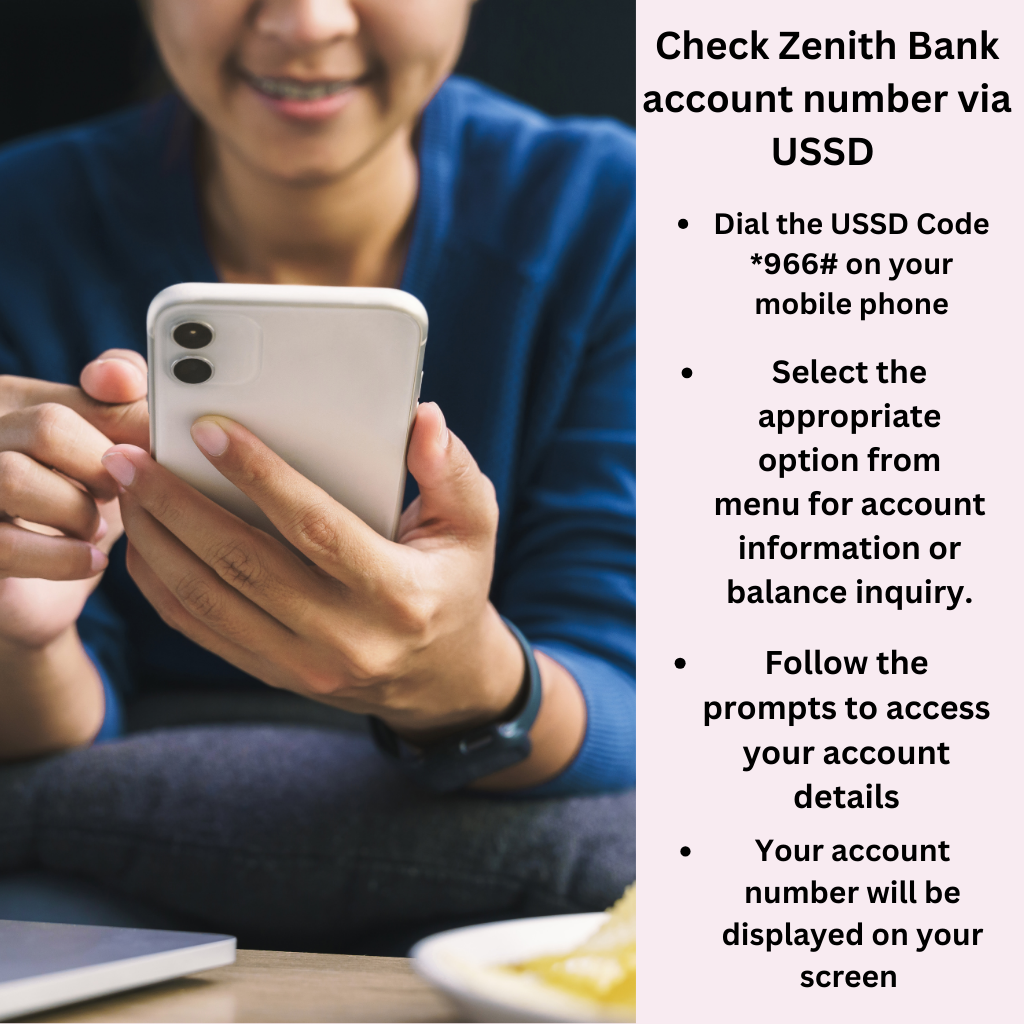

Check Zenith Bank account number via USSD

Follow these simple steps:

1. Dial the USSD Code , Start by dialing *966# on your mobile phone. Ensure you use the phone number linked to your Zenith Bank account.

2. After dialing, you will receive a menu with various options. Select the appropriate option for account information or balance inquiry. Follow the prompts to access your account details.

3Your account number will be displayed on your screen along with other relevant account information.

The advantages of using USSD include its speed and accessibility, as it doesn’t require data or an app. This method is particularly useful for individuals who prefer a straightforward way to access their banking details, ensuring they can manage their finances efficiently, even without advanced technology.

How to Check Zenith Bank Account Number via Online Banking

Accessing your Zenith Bank account number through online banking is easy.

Follow these detailed steps:

– Open your web browser.

– Type in the URL for Zenith Bank’s official website: [zenithbank.com](https://www.zenithbank.com).

– Ensure the site is secure (look for “https” in the URL).

– Click on the “Login” button, usually found at the top right corner of the homepage.

– Enter your user ID and password. If you haven’t registered, follow the prompts to set up your online banking account.

– Once logged in, look for options such as “Account Overview” or “Account Details” in the menu.

– Click on the relevant link to access your account information.

– Your account number should be listed along with other account details, such as balance and recent transactions.

Tips for Ensuring a Secure Online Banking Experience

Use a Secure Connection:

– Avoid public Wi-Fi. Use a private and secure network when accessing your account.

Enable Two-Factor Authentication:

– If the option is available, enable two-factor authentication for enhanced security.

Regularly Update Your Password:

– Change your password frequently and use a strong combination of letters, numbers, and symbols.

By following these steps and security tips, you can efficiently and safely check Zenith Bank account number online.

Know Your Zenith Bank account number Contacting Customer Service

If you prefer personalized assistance, contacting Zenith Bank customer service is a reliable option. You can reach them through several channels:

1. Phone Support: Call the Zenith Bank customer service number, which can be found on their official website. They usually have dedicated lines for account inquiries.

2. Online Chat: Visit the Zenith Bank website and look for the live chat feature. This allows you to speak with a representative in real time.

Speaking with a customer service representative to check Zenith Bank account number provides personalized help and ensures you get accurate information regarding your account number and other inquiries.

In conclusion,

You can check Zenith Bank account number through mobile banking, USSD codes, online banking, by visiting a branch, or by contacting customer service. Choose the method that best suits your preferences for convenience and security, and always remember to keep your account information secure.

Read More

Access Bank Account Number Check on Phone